Measure These 7 Corporate Real Estate Metrics in 2025

After years of forecasting impending doom over offices sitting empty, corporate real estate is on a tentative rebound.

Office space investment demand has surged by 57%. Interest in leasing office space is up 11%. Real estate investment trusts specializing in office space saw a 30% stock increase in 2024.

But we’re not out of the woods yet. Demand for office space is still expected to be 13% lower in 2030 than it was in 2019.

Although we’ve seemed to have hit a global equilibrium in office attendance with employees averaging 3.5 days per week, ROI on CRE portfolios isn’t a given. That’s because having any number of people at desks does not equal success.

ROI isn’t just the right number of people using the space your organization has bought or leased. It’s also the quality of the work produced, the social connections formed, the carbon emissions reduced and the culture that’s created.

So the metrics workplace leaders need to measure CRE portfolio success have become…slightly more complex, let’s say.

The name of the CRE game isn’t efficiency anymore. It’s effectiveness.

So with that in mind, here are 7 corporate real estate metrics for a more effective portfolio in 2025.

1. Total occupancy cost (versus all other corporate real estate metrics)

What it is: The sum of all the expenses of owning, leasing and operating corporate real estate. This includes rent, taxes, utilities and facilities management costs, all the way down to how much it costs to restock the vending machines every week.

How to use it: A word of warning. Total occupancy cost only provides a small part of the picture when it comes to measuring corporate real estate portfolio performance. An office in a prime location with the highest occupancy cost could actually be delivering the highest ROI, simply because employees love coming in and do their best work there. These days, total occupancy cost only tells you how much the portfolio costs monetarily, but not how it’s actually performing. It doesn’t measure carbon emissions, another huge priority for workplace leaders. That’s why it’s only useful for measuring performance when compared to the other metrics we’ll get into here.

How a Fortune 500 Company Reduced Their CRE Portfolio by 40% with HubStar

Saving millions in operating costs and reduce carbon footprint without impacting workplace experience? This firm pulled it off.

2. Occupancy rate

What it is: The percent of a workplace that’s occupied at any given time as compared to its full capacity. Simply put, occupancy rate provides an average of how full or empty the office is.

How to use it: Occupancy rate is a good way to answer the constant question of whether people are coming into the office or not. It’s also useful to compare occupancy rates to total occupancy costs to start the process of working out whether the most expensive assets in the portfolio are the ones employees are actually going into.

3. Space utilization rate

What it is: While occupancy rate measures if people are occupying a space, space utilization rate measures how effectively people are using that space – from floors in a building down to zones, neighborhoods and even conference rooms.

For example, occupancy rate could show that a fair amount of people are coming into the office, but space utilization rate could show that everyone is crowding the conference rooms on the first floor, while the desks on the second floor have tumbleweeds rolling through them.

How to use it: Office space utilization rate shows corporate real estate leaders how workspaces can be better used and managed. With space utilization data collected through occupancy sensors, WiFi signals, badge swipes and data from desk and room booking systems, workplace leaders can pinpoint over and undercrowded areas, smooth over uneven occupancy and decide which parts of the CRE portfolio to let go or repurpose.

5 Space Utilization Metrics for a Better Workplace in 2025

Here are some metrics to hone in on across your CRE portfolio to build a more effective workplace.

4. Space Utilization Trends

What it is: The overall direction of space utilization rate over weeks, months and years, whether that’s up, down or a consistent plateau.

How to use it: This corporate real estate metric is the best possible answer to whether or not people are coming into the office. That’s because plotting the dates of policy, office layout and office design changes on the trend line clearly demonstrates what’s working and what’s not.

Space utilization trends also guide portfolio decisions in the future. If an office with a higher occupancy cost also shows utilization rates on every floor steadily increasing over the last 6 months, it’s probably worth holding onto rather than giving up or subleasing.

5. Space Utilization Patterns

What is is: Repeatable, recognizable movements in short-term utilization rates, typically over days or weeks.

How to use it: Corporate real estate leaders and their teams can manage workspaces more efficiently by understanding which spaces are overcrowded or under-occupied, and on which days.

Let’s say the second floor has a 3% occupancy rate on Fridays. Making some attendance tweaks – for example, asking a team that struggles to find enough space on Tuesday to come in for a weekly meeting on Friday instead – reduces overcrowding and improves experience.

6. Peak Space Utilization Rate

What it is: The utilization rate of specific workspaces when they’re at their peak occupancy, and how close this is coming to total capacity .

How to use it: Determine if individual floors and areas are overcrowded or underused when they’re at peak occupancy. Both create a negative workplace experience. No one wants to do their morning commute only to have to fight over desk space or be the only one in the office.

Low peak space utilization also suggests wastage of utilities and facilities management services.

7. Comparative Utilization Rates

What it is: Space utilization rate comparison across buildings, cities and regions.

How to use it: Comparing utilization rates from the same time periods tells you which assets in your portfolio are performing the best in terms of popularity with employees. On a more granular level, comparison tells you which types of spaces employees use the most, and whether this is consistent across workplaces.

Most people view the office as a place for collaboration and brainstorming, but some employees come in for quiet focus spaces. Comparing how employees use spaces is ammunition for corporate real estate leaders to make the right decisions for office design and portfolio resizing.

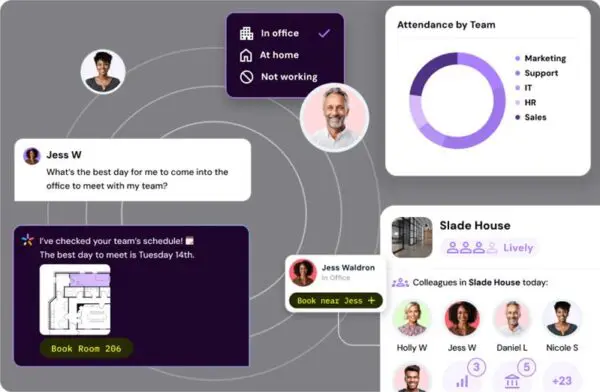

Measure these metrics and more with HubStar H2O

The only dynamic workplace management platform that helps workplace leaders not only reduce costs, but boost effectiveness and improve workplace experience too.

Share this post

You might also like